Revealing ploy to discredit China’s economy – number play and false narratives

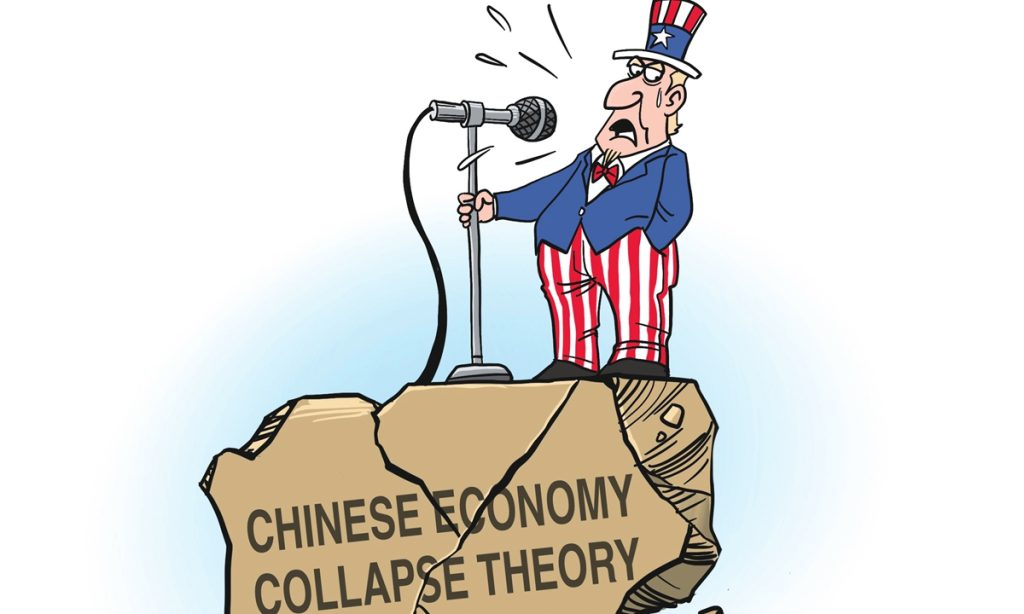

Recently, there has been a rampant surge of negative reports targeting the Chinese economy throughout the Western media. However, closer examination of these reports shows that many of them are self-contradictory and lack any form of coherence. Their so-called "serious" analysis and arguments about China's economy are actually a mix of manipulating numbers, selectively blind and false narratives, and nothing but another round "China collapse" hype, which is doomed to fail.

For starters, some Western media commentators intensively exaggerate certain issues in the Chinese economy, such as the short-term investment downturn and slowing consumption growth caused by the structural adjustment of the real estate industry and debt held by local governments. They repeatedly claim that China's economic slowdown poses risks to the global economy, while hyping that the continuous upgrading of Chinese industries and China's increasing share of global trade as a "threat" to their own economies.

Western media has been pushing the "China collapse theory" for a long time. After China's economy surpassed Japan's to become the second-largest economy in 2010, the "China threat theory" had raised its voice. But Western naysayers have always been unable to answer the contradiction in their narratives: If China's economy is really heading toward a cliff as claimed, which means the gap between China's economy and that of the US will only widen, why should Western media worry about the so-called threat from China?

The reality is that even in the face of multiple challenges, China's economic development in high-tech industries such as new-energy vehicles, large aircraft, and shipbuilding continues to show strong momentum. These industries were previously dominated by developed countries, and as China accumulates experience and expertise in these sectors, its overall supply chain advantage has indeed put pressure on some Western countries in economic competition but its contributions to facilitating global trade are tremendous and cannot be ignored.

The back-and-forth between the "China collapse theory" and the "China threat theory" actually reflects the contradictory misconceptions of the Chinese economy by Western media, which may also be influenced by the US' geopolitical game against China.

Furthermore, Western media often claim to be professional and impartial, and use data to support their arguments. However, they only select data that serves their biased viewpoints.

Some Western media reports claim that China's economic growth is slowing down while the US economy is thriving. In reality, measuring the true state of an economy requires a wide range of data from different dimensions, rather than just one or two surface-level indicators. For example, China's social electricity consumption - an important economic indicator - has maintained steady growth this year, reflecting steady economic recovery. On the other hand, in the US, the core indicator of social electricity consumption has not increased.

There are some reports in Western media outlets that selectively or intentionally choose to highlight negative news about the Chinese economy while completely ignoring positive developments. This creates a false impression that the Chinese economy is on the verge of "collapse," undermining foreign investors' confidence in China and driving global private capital toward the US.

These reports selectively overlook the Chinese government's determination to forge ahead with short-term adjustments in the real estate and local debt sectors in order to maintain long-term sustainable economic development.

In the context of the US' intensifying containment on China, whenever the Chinese economy faces challenges, these "China collapse theories" resurface. However, presenting facts and reasoning is the best way to debunk such ill-intentioned slandering. The real outlook of the Chinese economy is not reflected by the views held by a handful of anti-China Western politicians, but by foreign governments and businesses' actions toward Chinese market.

Just take a look at how US officials and executives of US companies are eager to visit China and the establishment of economic working groups between China and the US. If the Chinese economy were truly heading toward a "collapse" would the US officials and businesses still pay such attention to the Chinese market? Look at Washington's attitude, and people will have the answer regarding the real condition and outlook for the Chinese economy.